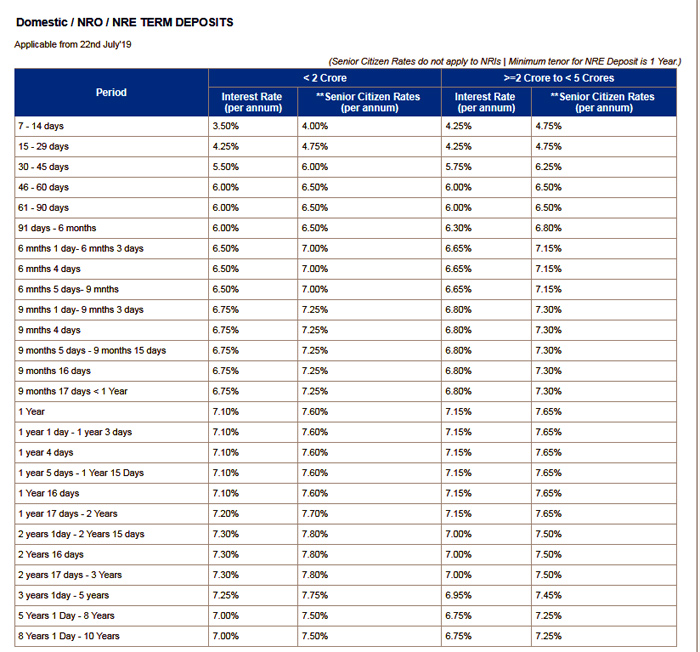

Now get an exclusive additional interest rate of 0.30% per annum on your Fixed Deposits above 5 years tenure Resident Senior citizen customers, will get an additional interest rate of 0.30% for limited time over and above existing additional rate of 0.50% per annum. ‘Company Fixed Deposits’ (CFDs) are Term Deposits offered by companies viz. Manufacturing firms and housing finance ventures. They usually offer a higher interest rate as compared to banks and Non-Banking Financial Companies (NBFCs).

- Rate Of Interest On Fixed Deposits

- Fixed Deposit Interest Rates 2019

- Rate Of Interest On Fixed Deposit In Bob Bank

Fixed deposit is a financial investment instrument offered by banks and NBFCs wherein investors can deposit money and get a high rate of interest than a normal savings account. Fixed Deposit is a great way to grow your savings with utmost safety. Once your investment amount has been locked in at a specific interest rate, it remains unaffected by further changes in interest rates or market fluctuations. Thus, you can get guaranteed returns on your deposit, and you can choose to get your interest on a periodic basis, or at maturity.

Senior citizens are usually offered higher interest rates as compared to the general public. Senior Citizen Fixed Deposits (FDs) are term deposit plans with special interest rates offered by leading banks to individuals who are over the age of 60. The senior citizen fixed deposit accounts offer a wide range of benefits to senior citizens, apart from the additional rate of interest that can go up to 0.50% more than for the general public.

FD account tenure:

Banks have defined a minimum and maximum period for which FD accounts can be opened with them. Usually, one can invest in an FD for a minimum of 7 days and a maximum of 10 years.

Advantages of fixed deposits:

Tax Benefits: Tax-saver FD attracts tax benefits under section 80C of the Income Tax Act, 1961. It falls under the Exempt-Tax-Exempt category. Although the interest earned on such FDs is taxable, you can claim a deduction of a maximum of Rs. 1,50,000 for the amount invested.

Safe Investment: FDs are risk-free investments. Unlike other investment tools, FDs are not market-driven. You get an assured sum of money at the end of the maturity period.

Rate Of Interest On Fixed Deposits

Top tax saver FD interest rates:

Banks | Tax Saver FD Interest Rates General | Tax Saver FD Interest Rates Senior Citizens |

DCB Bank | 6.75% | 7.25% |

IDFC First Bank | 5.75% | 6.25% |

YES Bank | 6.75% | 7.50% |

IndusInd Bank | 6.50% | 7.00% |

RBL Bank | 6.40% | 6.90% |

Federal Bank | 5.50% | 6.00% |

Axis Bank | 5.50% | 6.00% |

State Bank of India | 5.40% | 6.20% |

IDBI Bank | 5.10% | 5.60% |

HDFC Bank | 5.30% | 5.30% |

Fixed Deposit Interest Rates 2019

Tax-saver FDs offer a maximum deduction of Rs.1.5 lakh under Section 80C of the Income Tax Act with the maximum deposit permissible being Rs.1.5 lakh. The lock-in period is 5 years. Senior citizens are offered a 0.50% additional interest rate.

Rate Of Interest On Fixed Deposit In Bob Bank

READ: How to track passport application status online: Check details here