Nearly two-thirds of all tax returns are now delivered electronically to the Canada Revenue Agency — a percentage that has seen steady growth every year since EFiling and Netfiling began.

It's not hard to see why the electronic option is becoming ever more popular. It's fast, secure, more accurate, and refunds can take as little as eight business days with direct deposit.

For a mailed return you can wait as long as six weeks to get a refund.

With tax deadlines approaching, a variety of software programs are once again available so Canadians can file electronically. Most cost money, but some are free for those with modest incomes. A few are offered free to everybody.

How we filed in 2011

- Paper: 8,569,627 (34.96%)

- Netfile: 5,025,772 (20.50%)

- Efile: 10,563,392 (43.09%)

- Telefile: 353,482 (1.44%)

- Total: 24,512,273 (100.00%)

Solved: just want to know if my 2016 turbotax windows tax file can be transferred to a 2017 online turbotax mac version before I buy the 2017 turbotax for mac. TurboTax Premier —for investments and rental properties, up to 12 returns—$79.99. TurboTax Home & Business —consultants and small business owners, up to 12 returns—$129.99. TurboTax 20 Returns —home and business, up to 20 Returns —$139.99. TurboTax Business Incorporated —one corporate T2 return —$249.99. TaxTron has been helping Canadians prepare their own tax returns for over 20 years. TaxTron was the first available tax software for Macintosh computers, and one of the first to support electronic filing of.

Source: Canada Revenue Agency

For the do-it-yourself types, this means using the CRA's Netfile system, a web-based service that allows taxpayers to be their own accountants and file their returns over the internet. (EFile is the internet-based filing system used by professionals who prepare tax returns for a living).

The CRA received about 5 million tax returns through the Netfile system in 2011, an increase of six per cent from the previous year and far more than the 530 who filed this way when the program debuted in 1999.

'Using tax software is a fantastic way for people to avoid the tax math,' says tax educator and author Evelyn Jacks, president of Winnipeg-based Knowledge Bureau. 'It offers a great way to do some 'what if' scenarios, too.'

How to Netfile

You'll need an access code to Netfile your taxes. You can find that on the label sheet of your T1 personal income tax return package, or you can go online and enter some key data. (You'll need last year's tax return handy.)

Unfortunately, if you've never filed a tax return before, you won't be able to Netfile.

Once you have the access code, all you need now is a 'certified' tax program. The CRA has a list of certified programs on its website and it will be updated through March as more programs satisfy the certification requirements.

The Netfile service is open from Feb. 13 to Sept. 30 for filing 2011 returns.

Preparation tip

Evelyn Jacks suggests people who are preparing returns for a number of family members work from the lowest income earner to the highest.

'When you work in order, you'll maximize transferable deductions and credits and optimize income splitting opportunities, too — to file all the returns to the family unit's best benefit.'

Tax Software For Mac Computers

Taxpayers have two main options: using software that is loaded onto a computer's hard drive or using interactive web-based programs. From these you can either file electronically or print out returns and mail them by post.

Some programs can be bought in a store and come on a CD-ROM that installs the software on your hard drive. Others allow users to download the software directly from the company. Some programs offer both versions.

Often, these programs allow you to prepare multiple returns but tend to be more expensive than the web-based tax programs where users interactively prepare their returns online without downloading the software.

For security reasons, the CRA says no more than 20 returns may be filed through any single program that uses Netfile.

Here's a quick look at the particular bells and whistles of some of the most popular tax-preparation programs certified for Netfiling.

CD-ROM/downloadable programs

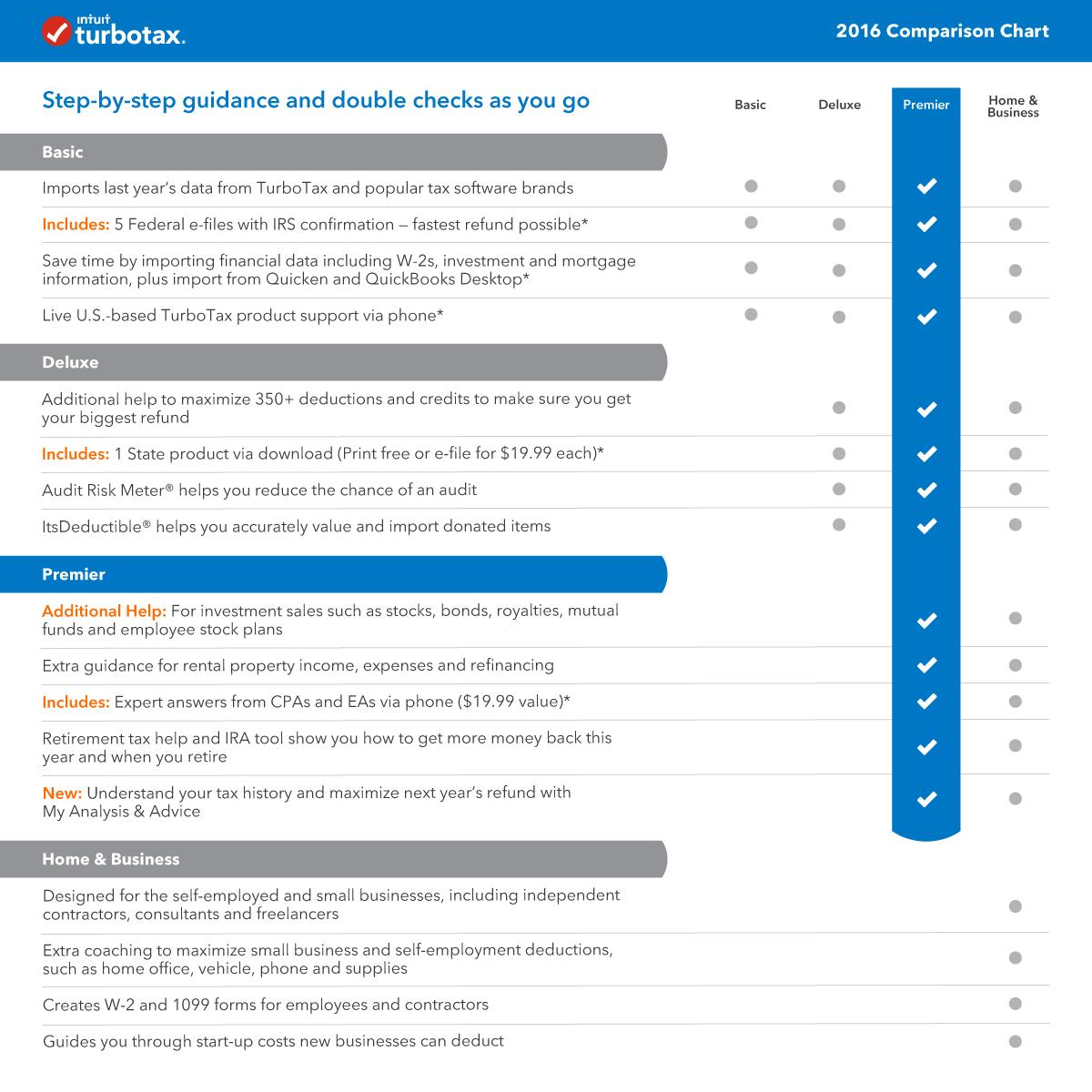

TurboTax

TurboTax is the new name for QuickTax, Intuit's popular tax-preparation software. The Basic edition costs $19.99 for eight returns and is for those with simple returns to file— in other words, those with just T4 slips and charitable donations.

The Standard edition costs $39.99 for eight returns and is suitable for those who have RRSPs or medical expenses to claim.

The $69.99 Premier version adds features for those with rental or investment income to report. The $99.99 Home and Business edition is mainly for those with business taxes to file.

All versions allow users to import data from Quicken, financial management software also made by Intuit. All of the CD-ROM/downloadable versions are for PCs only. If you have a Mac, you'll need an online version (see below).

UFile for Windows

Like TurboTax, UFile uses the interview method to lead users through the tax-preparation process.

UFile can be installed on your computer (either downloaded or with a CD-ROM) for a suggested retail price of $29.99 (some stores sell it for $19.99) and allows users to prepare as many as eight returns.

Deadlines

For Netfile: Service will open on Feb. 13, 2012 and will close on Sept. 30, 2012.

For filing 2011 personal tax returns: April 30, 2012.

Penalty for filing late: 5% of tax owing, plus 1% per month.

Source: Canada Revenue Agency

It can handle self-employment income, including income from rental properties.

Additional returns can be purchased through the company's website. A non-downloadable UFile Plus allows users to file up to 16 returns and is available in stores for $29.99.

H&R Block at Home

H&R Block at Home deluxe tax software allows you to prepare up to 16 tax returns for $29.99.

Like its main competitors, it employs the question-and-answer format and allows you to import your tax data from other software products.

The Windows-only software can prepare a number of different personal returns including multiple small businesses, rental properties, commission or foreign income and childcare expenses.

TaxTron

TaxTron uses a 'step-by-step' approach and its software is available through its website.

Windows users can purchase an individual license for $12.99 and file one return for a taxpayer with a net income over $30,000 and 19 returns for income under $30,000.

A family licence, which costs $24.99, will allow you to prepare and file five returns for earners with a net income over $30,000 and 15 returns for earners with income under $30,000. For those with Macs, the cost is $19.99 for a single licence and $39.99 for a family.

AceTax

This downloadable software is available for both PCs and Macs in a number of packages depending on the number of returns filed, from $8.99 for one, $11.99 for two, $15.99 for five, $19.99 for 10 and $29.99 for 20.

However, returning customers can purchase the same packages for $2 less. Offers free service to families earning less than $10,000.

FutureTax

This downloadable program charges $5.99 for one return, $7.99 for two returns, $9.99 for 10 returns or $15.99 for 20 returns. It is not available for Macs. It also cannot be used to file Quebec provincial returns.

MyTaxExpress

This downloadable software costs $6.99 for one return and $13.99 for a licence that allows users to prepare up to 10 returns. It's free for families with a total income below $10,000. There is a $5 fee if users want to receive the CD-ROM version of the software. It can't be used to file Quebec provincial returns. For Windows or Linux only. Not available for Macs.

TaxFreeway

TaxFreeway is a downloadable program that costs $9.95 for up to 20 returns (the version for Macs is $14.95). This year, it also offers a '3-in-1' package for $19.95 that allows users to file up to 20 returns using PCs, Macs or an iPad. It says it's the only Canadian tax software that allows users to work in interview and form modes simultaneously.

StudioTax 2011

StudioTax 2011 is the work of BHOK IT Consulting, a group of software professionals in the Ottawa area. It's free to download and use regardless of income, but asks for donations. One caveat: it's Windows only. The company's website says that 'hundreds of thousands' use its free service.

EasyCTax

EasyCTax, available as both a downloadable program and a web application, costs $9.95 for the first return and $5 for each additional family member. Alternatively, you can pay $24.95 to file as many as 20 returns. The software is available for free if family income is less than $25,000. However, it is only available for tax filers in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick and Nova Scotia.

Web applications

TurboTax Online

The online version of TurboTax Standard is $17.99 for a single return, which will suffice for typical taxpayers with the usual claims like RRSP deductions, charitable donations and medical expenses.

But the company offers a free version for taxpayers with simple taxes to file. And they mean simple: no RRSPs, no investment income, no charitable donations and no pension or income from tips. There's also a free version for students with gross incomes below $20,000.

An app for taxes

For those who are in a real hurry, Intuit, the company that produces the TurboTax software, now offers an iPhone app that will calculate your return in a matter of minutes.

Users simply take pictures of their T4 slips with the SnapTax app and answer a few questions before filing with the CRA's Netfile system through their phone. It costs $9.99.

SnapTax cannot calculate Quebec returns and is unavailable to people over the age of 65 or anyone with either children or dependants.

A Premier edition for those with investment or rental property income is $32.99 for a single return. A Home and Business edition is also available online for $44.99 per return.

Ufile

Ufile's online solution costs $15.95 for the first family member or $24.95 to include a spouse. You can file tax returns for dependent family members for free. All students and families with a total income of less than $20,000 can also file for free.

H&R Block at Home

H&R Block has an online version for those who want to do their own return. H&R Block charges $15.95 for one return and $10 for a second family member. Once a person has paid $25.95, additional family members can file for free.

H&R Block also offers its web application at no cost for families whose total income is $20,000 or less.

EachTax

EachTax.com charges $5.99 for the first return and $3.99 for each additional return. Family members of a paying EachTax.com customer who earn less than $25,000 a year can file for free. It's advertising that new customers can file for free this year, regardless of income. The software cannot calculate Quebec provincial returns.

TaxChopper (formerly CuteTax Online)

TaxChopper costs $9.98 for one return, $15.98 for two returns, $19.98 for three to five returns and $25.98 for six to 15 returns. It's free for singles with incomes below $25,000, couples with incomes below $30,000 and students who spent six months of the tax year enrolled in full-time studies.

WebTax4U.ca

This web application, available from MacroNT Inc., costs $12.99 for the first return and $5.99 for each additional family member. It's free for those with total family incomes below $20,000.

Taxnic

This online program charges $8.99 for the first return, $13.99 for two returns or $18.99 for up to twenty returns. It is free for singles with total income below $20,000 and couples with total income below $25,000.

GenuTax Standard

This web application cost $39.99 and allows you to file up to 20 returns regardless of income level. Its website say that updates for future tax years will be provided for free so there is no need to purchase new software each year.

FileTaxOnline

FileTaxOnline is a web application that costs $9.98 for an individual return or $15.98 for a family return. It's free if your total family income is less than $20,000. It is not available in Quebec.

2012 Tax Software Canada For Mac Osx

Other options

Finally, time for a quick mention of TaxMan — the work of an opinionated Victoria man who calls himself 'the poor man's accountant.'

His offering is a 'moron-simple' 28,000-line tax software program that uses CRA-approved forms. You can't Netfile this baby — you'll have to print it up and mail it in — but it is free, regardless of the number of returns or income.

TaxMan does, however, accept donations, for those who feel so inclined.

Of course, everyone who uses tax software can always file the old-fashioned way — on paper, via Canada Post. You just do your data entry through the program and then print the results and send them in.

You can also download all the forms you need from the Canada Revenue Agency's website or pick up a tax package at a CRA service kiosk or at the post office and fill everything out (shudder) by hand.

Please help us keep StudioTax success story alive!

Please don't forget to spread the word by sending StudioTax link to your friends and family.

Who can use StudioTax?

StudioTax is made available for individuals who prepare their own tax returns or returns for a small number of relatives and friends.

It is important to note that, as per CRA regulations, tax professionals CANNOT use NETFILE software to file tax returns of their clients. They must use EFILE certified software.

Is StudioTax right for you?

Every year 100's of thousands of taxpayers use StudioTax to prepare and file their returns. And more taxpayers are converting to StudioTax every year.

StudioTax covers the overwhelming range of personal income tax scenarios from simple tax returns to more involved returns for self-employed, returns with rental income and everything in between.

How about if I need more than 20 returns?

The 20 returns limit is a CRA requirement. If you are a tax preparer, then get an unlimited number of returns by using Studiotax Enterprise.

Can I import last year's return created by another tax program?

Unfortunately you have to do that manually. Only StudioTax returns can be imported by StudioTax.

Note that StudioTax may not handle some uncommon tax situations. Please review the restrictions page for a detailed list of exclusions.

For Tax Professionals

If you are a tax preparer, then visit www.StudioTax.ca to learn more about StudioTax Enterprise and to download a trial copy.

Please note that the professional version is designed for tax preparers registered with CRA. Please visit the CRA web site to find out how you can register as a tax preparer. If you are not a tax preparer, then StudioTax Enterprise version will not work for you and you should use our fully functional NETFILE certified version to prepare and file your return.